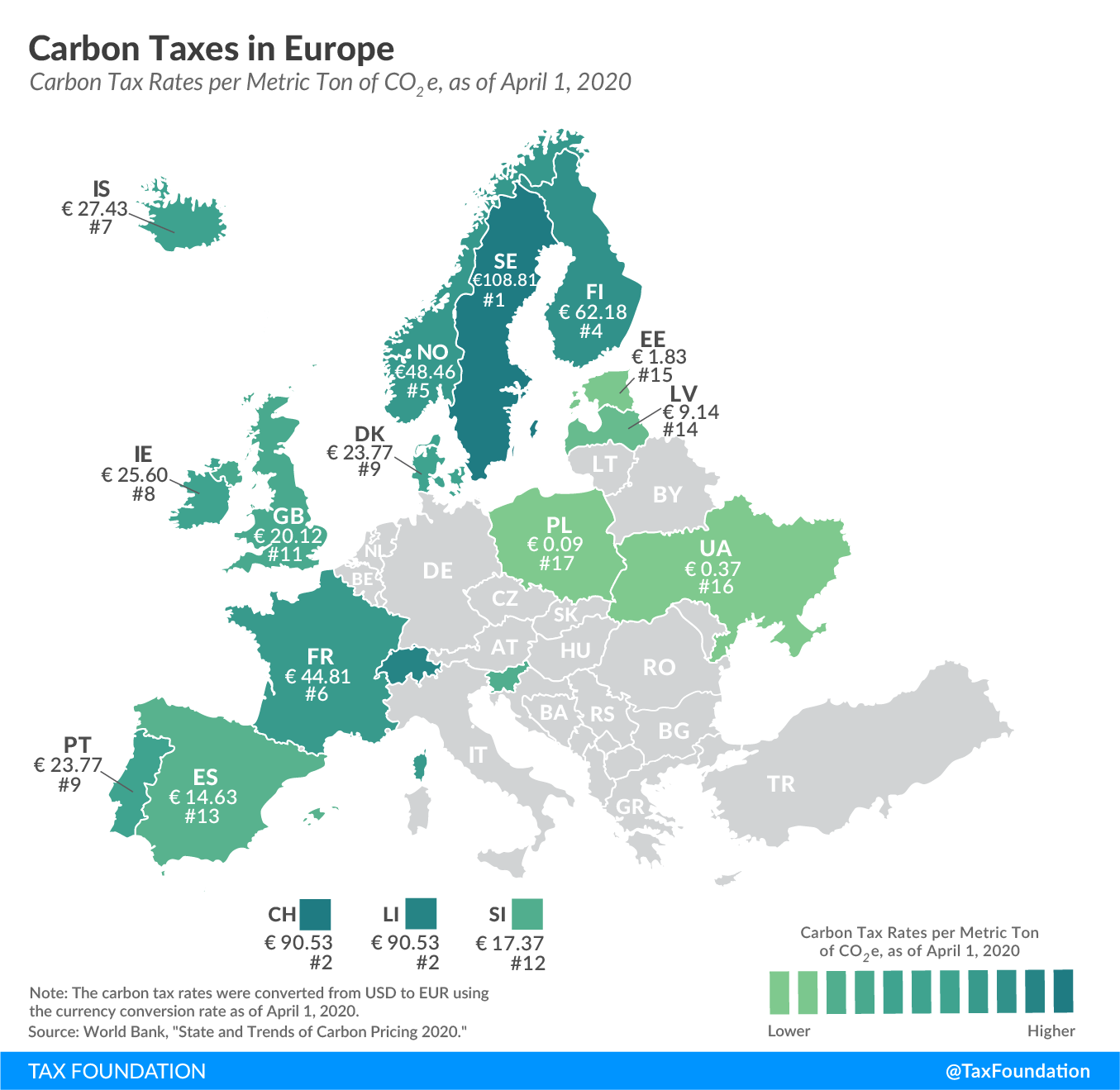

Carbon Taxes in Europe, 2020

3 min readBy:In recent years, several countries have taken measures to reduce carbon emissions using environmental regulations, emissions trading systems (ETS), and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax. Since then, 16 European countries have followed, implementing carbon taxes that range from less than €1 per metric ton of carbon emissions in Ukraine and Poland to over €100 in Sweden.

Sweden levies the highest carbon tax rate at €108.81 (US $119) per ton of carbon emissions, followed by Switzerland and Liechtenstein (€90.53, $99) and Finland (€62.18, $68). You’ll find the lowest carbon taxA carbon tax is levied on the carbon content of fossil fuels. The term can also refer to taxing other types of greenhouse gas emissions, such as methane. A carbon tax puts a price on those emissions to encourage consumers, businesses, and governments to produce less of them. rates in Poland (€0.09, $0.10), Ukraine (€0.37, $0.40), and Estonia (€1.83, $2).

Carbon taxes can be levied on different types of greenhouse gases, such as carbon dioxide, methane, nitrous oxide, and fluorinated gases. The scope of each country’s carbon taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. differs, resulting in varying shares of greenhouse gas emissions covered by the tax. For example, Spain’s carbon tax only applies to fluorinated gases, taxing only 3 percent of the country’s total greenhouse gas emissions. Norway, by contrast, recently abolished most exemptions and reduced rates, now covering over 60 percent of its emissions.

All member states of the European Union (plus Iceland, Liechtenstein, and Norway) are part of the EU Emissions Trading System (EU ETS), a market created to trade a capped number of greenhouse gas emission allowances. With the exception of Switzerland and Ukraine, all European countries that levy a carbon tax are also part of the EU ETS. (Switzerland has its own emissions trading system, which is tied to the EU ETS since January 2020.)

Several European countries are currently considering or have announced the implementation of a carbon tax or an ETS. For example, Germany will implement a national ETS for the heat and road transport sectors—both not covered by the EU ETS—in January 2021. Luxembourg plans to implement a €20 ($22) per ton of CO2 carbon tax in 2021, and Austria has announced its intention to introduce some form of carbon pricing.

|

Carbon Tax Rate |

Share of Jurisdiction’s Greenhouse Gas Emissions Covered |

Year of Implementation |

||

|---|---|---|---|---|

|

Euros |

US-Dollars |

|||

| €23.77 | $26.00 | 40% | 1992 | |

| €1.83 | $2.00 | 3% | 2000 | |

| €62.18 | $68.00 | 36% | 1990 | |

| €44.81 | $49.00 | 35% | 2014 | |

| €27.43 | $30.00 | 29% | 2010 | |

| €25.60 | $28.00 | 49% | 2010 | |

| €9.14 | $10.00 | 15% | 2004 | |

|

Liechtenstein (LI) |

€90.53 | $99.00 | 26% | 2008 |

| €48.46 | $53.00 | 62% | 1991 | |

| €0.09 | $0.10 | 4% | 1990 | |

| €23.77 | $26.00 | 29% | 2015 | |

| €17.37 | $19.00 | 24% | 1996 | |

| €14.63 | $16.00 | 3% | 2014 | |

| €108.81 | $119.00 | 40% | 1991 | |

| €90.53 | $99.00 | 33% | 2008 | |

|

Ukraine (UA) |

€0.37 | $0.40 | 71% | 2011 |

| €20.12 | $22.00 | 23% | 2013 | |

|

|

€35.85 |

$ 39.21 |

31% |

|

|

Notes: *Portugal ties its carbon tax rate to the previous year’s EU ETS allowances price. **The United Kingdom’s carbon tax is tied to the EU ETS’s allowances price. The tax rate is determined as the difference between the EU ETS price and the UK’s annual increasing carbon price floor target. The carbon tax rates were converted from USD into EUR using currency conversion rates as of April 1, 2020. Sources: The World Bank, “State and Trends of Carbon Pricing 2020,” May 2020, https://openknowledge.worldbank.org/handle/10986/33809, and The World Bank, “Carbon Pricing Dashboard,” last updated Aug. 1, 2020, https://carbonpricingdashboard.worldbank.org/map_data. |

||||

Launch Carbon Tax Resource Center

Share this article